Hello everyone, this is Akito from Singapore.

Elon Musk is best known for co-founding Tesla — but his SpaceX business is an extraordinary story of its own. The 21-year-old company launched an average of a rocket every six days last year, almost double its rate for 2021.

A few years back, a source told me how a major Japanese company that was deploying a satellite using SpaceX asked Musk to participate in the launch. The entrepreneur’s staff declined the offer on Musk’s behalf because, for him, such events were already routine, my contact explained.

I recalled this conversation as I watched Tuesday’s Japan Aerospace Exploration Agency (Jaxa) livestream from south Japan’s beautiful Tanegashima island. The agency was set to launch the domestically produced H3 rocket — and take a giant leap towards making Japan a serious player in the commercial space market.

After the countdown, the 63-meter rocket appeared to take off smoothly. But within minutes it became clear something was wrong. Shortly afterwards came the announcement that the second stage ignition had failed — and Jaxa had ordered the $1.5bn rocket and its satellite payload to self-destruct.

Japan’s rocket failure

The aborted H3 mission is a severe blow to Japan’s outer space ambitions, writes Nikkei Asia’s chief business news correspondent Mitsuru Obe.

The H3 was supposed to play a vital part in helping the country hit its target of doubling the number of its intelligence-gathering satellites. H3 was expected to be handed over to Mitsubishi Heavy Industries, the rocket’s prime contractor, as a private business, with agreements already in place to launch satellites for British company Inmarsat.

The H3 was billed as a more powerful, cheaper and safer successor to the H2A rocket, which is due to be retired by the end of March 2025. The new craft was supposed to showcase Japan’s manufacturing prowess, but Tuesday’s debacle underscored that the nation’s space industry still has a way to go to catch up with Musk’s starships.

Arm’s China problem

The UK’s largest tech company Arm may have thought its China problems were a relic of the past with last year’s ousting of Allen Wu, the renegade CEO who personally took control of its China unit.

But now the UK chip designer and its owner Japanese investment group SoftBank have a new difficulty. Arm’s plan to offload its troubled joint venture in the country has not been well-received by Chinese officials, write the Financial Times’ Ryan McMorrow, Qianer Liu, Kana Inagaki and Anna Gross.

For more than eight months officials have declined to process the paperwork confirming the transfer of Arm China to a new SoftBank Vision Fund entity, part of a corporate restructuring to separate Arm from its China problems. Such paperwork ordinarily takes no more than 10 days to complete.

“China does not want to lose Arm at this juncture,” said a Chinese official involved in the process, adding: “The chip war between the US and China continues to escalate and Arm is a must-have ally for China’s chip industry.”

The delay complicates SoftBank’s plan to list Arm and raise much needed capital. While both groups have acted as if the transfer was complete for months and continue to publicly claim so, investors may not be equally willing to close their eyes to the unresolved restructuring.

So while Arm is pushing forward with its New York IPO, it still remains unclear what entities will constitute the company.

Generative AI frenzy

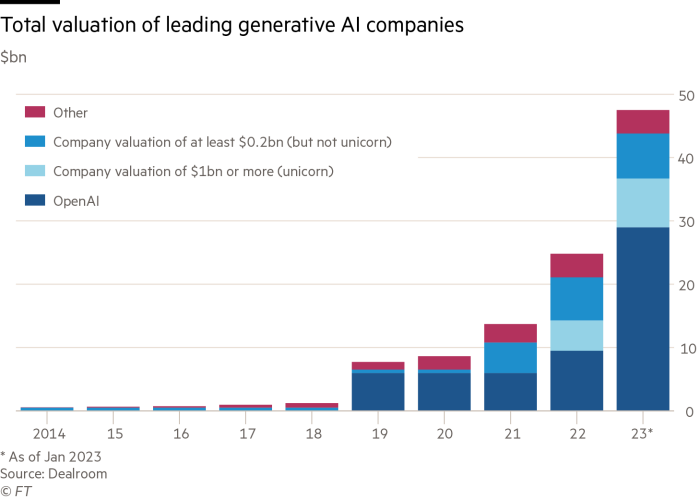

The chatbot technology fever since the release of Microsoft-backed OpenAI’s ChatGPT late last year has triggered a frenzy of investment. Financing of leading generative AI companies totalled $2.1bn in 2022, up tenfold from 2020, write Nikkei’s Kentaro Takeda, Akira Oikawa, and Yukiko Une.

Despite the headwinds facing start-up investments generally, the enterprise value of some 100 major generative AI companies totalled $48bn in January — a sixfold increase since the end of 2020. OpenAI alone is valued at an estimated $29bn, while US start-up Jasper AI and four others have also achieved unicorn status — valuations of $1bn or more.

AI has been generating massive amounts of text, imagery, and other content. The start-up companies now have to prove they can produce the cash to match the output — and the enormous financial investments they have devoured.

Grab ties with tech giants

Grab has made the latest move in its quest to generate the extra revenues it needs to make a profit: tie-ups with tech giants Amazon of the US and China’s Tencent Holdings.

The Singapore-based superapp has launched a joint service with WeChat, the all-purpose messaging app from Tencent, writes Nikkei’s Takashi Nakano. Users can now call for a ride by pressing the Grab icon embedded in the WeChat app. By integrating with WeChat, Grab hopes to tempt more customers by saving them the time of downloading a separate app.

Grab has also started providing map data to clients of Amazon Web Services, the US tech company’s cloud computing arm. AWS customers can tailor the data in eight south-east Asian countries to fit their businesses, generating revenues for Grab based on usage.

While Grab has been suffering quarterly losses for several years, shareholders in the Nasdaq-listed company have dialled up pressure lately for it to improve its finances. Grab last month said it aimed to bring adjusted ebitda (earnings before interest, taxes, depreciation and amortisation) to profit in the fourth quarter of 2023. The company has also indicated it will continue to cut costs where possible — another sign of the investor push for more.

Suggested reads

-

Taiwan’s Foxconn eyes new iPhone factories in India (Nikkei Asia)

-

About 100 Chinese Congress delegates chosen from US-targeted companies (Nikkei Asia)

-

Tencent boss Pony Ma left out of China’s signature political gathering (FT)

-

Sapporo taps AI to quench Japan’s thirst for cocktails in a can (Nikkei Asia)

-

Indonesia unveils EV subsidies to woo Tesla, BYD (Nikkei Asia)

-

Can TikTok convince the world it is not a tool for China? (FT)

-

US chip subsidies alarm Korean companies with tough conditions (FT)

-

Singapore’s Sea posts 1st quarterly profit after drastic cost cuts (Nikkei Asia)

#techAsia is co-ordinated by Nikkei Asia’s Katherine Creel in Tokyo, with assistance from the FT tech desk in London.

Sign up here at Nikkei Asia to receive #techAsia each week. The editorial team can be reached at techasia@nex.nikkei.co.jp