Hello, this is Kenji.

I just came back to Hong Kong on Tuesday evening from over two weeks of reporting in Europe, including at the World Economic Forum in Davos, Switzerland. The day before I left, news broke that Renault and Nissan had finally reached an agreement to reconfigure their 20-plus-year relationship.

When the Franco-Japanese alliance was forged in 1999, the driving force behind most global auto deals was size. Pressure was mounting on car manufacturers to reach a certain scale — the idea that a company needed to produce at least 4mn vehicles a year just to survive was widely accepted, at least among industry’s top management.

The French-led alliance was a typical cross-border tie-up of that time, and came just a year after the acquisition of Chrysler by Daimler-Benz sent shockwaves throughout the sector.

But in the past quarter of a century we have seen that bigger is not necessarily better. Chrysler was later spun off, while automakers that chose to stick to their own path without joining the “4mn club,” like Honda, not only survived but thrived.

Now the key consideration is tech, as competition shifts to electric vehicles and software-powered features. As a result car companies are courting players from outside the traditional auto industry to unleash the next generation of growth.

Deals motivated by tech sound more convincing than those based on a pursuit of volume, but let us see whether this new trend stands the test of history.

Shifting gears

Japan’s auto industry is waking up to the new tech-centric challenges that await.

Just a few day before Renault agreed to scale back its holding in Nissan to 15 per cent, equalising the two companies’ stakes in each other, Toyota made its own surprise announcement.

CEO Akio Toyoda announced he will step down in April and hand the reins to Koji Sato, a veteran engineer involved in some of Toyota’s most popular cars, including the Prius, writes Sayumi Take from Nikkei Asia. Unlike Nissan, Toyota has been a consistent leader among global carmakers. But even this titan of automaking is now seeking a change as it faces emerging challengers such as Tesla, a company that has been around for less than two decades.

Toyoda himself acknowledged that the company needed to evolve when he said, “A carmaker is all that I am, and I see that as my own limit.”

In the same week, Chinese automaker BYD made history when it started selling electric vehicles in Japan. It was hard to imagine just a few years back that Chinese-branded cars would be competing against Japan’s automaking kings on their home turf. While it is too early to say whether local consumers will embrace BYD, the tectonic shift in the industry seems irreversible.

Samsung’s spending

Samsung Electronics has defied growing pressure to rein in spending on new chip production facilities despite quarterly operating profit at the world’s largest memory chipmaker sliding to an eight-year low, write the Financial Times’ Song Jung-a and Christian Davies.

The sector is wrestling with a crisis of oversupply as customers pull back amid high inflation and rising interest rates. But the South Korean giant is sticking to its strategy of investing in a downturn in order to widen its lead over rivals.

Operating profit in its semiconductor division fell to Won270bn ($221mn) in the fourth quarter from Won8.83tn a year earlier. But Samsung said its spending this year would be similar to last year, at around Won53.1tn, as it predicted a second-half recovery in demand.

Samsung shares dropped 3.6 per cent on Tuesday as investors hoping for a stronger output cut were disappointed. Analysts caution that Samsung is heading towards huge losses in its chip division in the first half of this year.

In contrast, fellow South Korean chipmaker SK Hynix has announced plans to cut this year’s capital expenditure by 50 per cent. SK Hynix said on Wednesday that it had suffered an operating loss of Won1.7tn in the three months to December 2022, with sales falling 38 per cent to Won7.7tn.

Getting picky

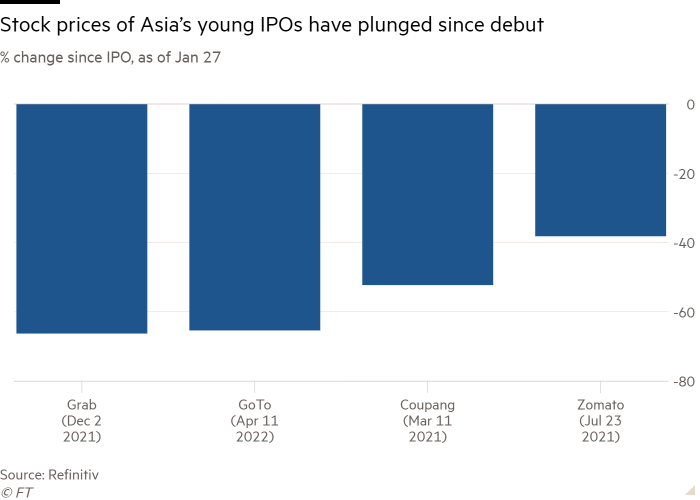

A series of rate hikes by the US Federal Reserve since last March followed by similar moves from other major central banks has changed the landscape for listed tech companies around the world, and those in Asia are no exception. Growth alone is no longer enough. Investors are starting to demand profit — or at least progress in that direction.

In south-east Asia, equity investors have been rewarding companies that appear to meet this new criterion, and punishing those that do not, Nikkei Asia’s Dylan Loh and Tsubasa Suruga report from Singapore.

Singaporean tech platform Grab is among the recent winners, although it is still well down on its IPO price. Indian food delivery app Zomato, the country’s first unicorn to go public, remains sluggish.

Unlisted start-ups have also faced tougher scrutiny from investors. Fundraising by Southeast Asian start-ups through equity and debt contracted by 31 per cent last year, after a bumper 2021. According to DealStreetAsia, which compiled the data, investors are now looking for both growth and free cash flow at the same time.

A new face at Foxconn

Foxconn, the world’s biggest iPhone assembler, made a surprise personnel announcement, naming Japanese auto industry veteran Jun Seki as the chief strategy officer of its electric vehicle arm, writes Nikkei Asia’s Lauly Li.

The 61-year-old Seki was a vice chief operating officer at Nissan before joining Nidec, the world’s biggest electric motor maker. He served as CEO of the company until last year, when he resigned after being demoted and openly criticised by Nidec’s outspoken founding Chairman Shigenobu Nagamori for “underperforming”.

Now Seki is rebooting his auto industry career at Foxconn, which plans to boost the revenue of its EV segment to 1tn Taiwan dollars ($32.7bn) by 2025, in order to lower its dependence on the smartphone business.

One question will be how Seki’s new relationship with Nagamori plays out, as Nidec has emerged as one of Foxconn’s close allies in its EV push.

Suggested reads

-

Jack Ma’s movements send Hong Kong penny stock soaring (Nikkei Asia)

-

Netherlands and Japan join US in restricting chip exports to China (FT)

-

Sony separates production of cameras for China and non-China markets (Nikkei Asia)

-

France looks to ASEAN for non-China supply chain: trade minister (Nikkei Asia)

-

Washington halts licences for US companies to export to Huawei (FT)

-

Taiwan, South Korea will remain key chip hubs, says MKS chief (Nikkei Asia)

-

Israeli tech sector warns of economic hit from Netanyahu’s hardline policies (FT)

-

Thailand’s first unicorn Flash Express hits the gas in Philippines (Nikkei Asia)

-

Lex — Semiconductor manufacturing equipment: Japanese makers weigh up cost of export controls (FT)

#techAsia is co-ordinated by Nikkei Asia’s Katherine Creel in Tokyo, with assistance from the FT tech desk in London.

Sign up here at Nikkei Asia to receive #techAsia each week. The editorial team can be reached at techasia@nex.nikkei.co.jp.